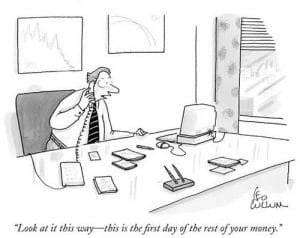

Critical Considerations for Advisors Nearing Retirement

Ever take a close look at what your firm’s retirement package would actually be worth to you? Probably not, especially if you get a recurring headache just trying to decipher your company’s compensation grid.

We are going to do our best to explain this arrangement to you as simply as possible, with the goal being to raise awareness of actual values versus what is being promoted, in addition to a potentially superior alternative.

We are going to do our best to explain this arrangement to you as simply as possible, with the goal being to raise awareness of actual values versus what is being promoted, in addition to a potentially superior alternative.

For the purposes of illustration, we are going to use a one-million dollar producer who is offered a “220%” sunset package with a built-in 4% annual production escalator and a five-year payout period.

The break down would look like this: Annual payouts of 60-50-40-35-35 percent of baseline T-12 (which, when added together, is where the great-sounding but misleading 220% comes from).

What is often left unspoken is the fact that before those “generous” percentages are actually dispersed to a retiring advisor, the numbers are first applied to the advisor’s compensation grid.

Assuming a 44% payout grid, this broker would receive gross disbursements of:

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Total Payout |

|---|---|---|---|---|---|

| $274,560.00 | $237,952.00 | $197,976.00 | $180,158.00 | $187,365.00 | $1,078,011.00 |

As you can see, the total payout figure does not represent anything remotely approaching 220% of $1,000.000.00.

In fact, if the book were to produce the exact same revenue over the five years following the broker’s retirement, the sunset payout equates to just 21.5% of that total production ($5,000,000.00). If the book’s production grows by the same 4% annually that is calculated in this particular sunset package, the full payout is only 19% of total production.

Worth noting is that even though the inheriting broker(s) will only be paid a fraction of their normal compensation on the retiring advisor’s book of business during the sunset period, they assume 100% of the work involved in servicing the inherited accounts. The firm ingeniously continues to receive its full, regular share of the revenue.

It is certainly reasonable for both retiring advisors and their clients to question whether it is realistic that the latter group is going to get the same level of care and attention they are used to having received from their previous broker.

Note: There are usually provisions that will reduce the payouts to the retiring broker if the book’s production falls significantly after it is transferred to the inheriting broker(s).

Finally, making this program even less attractive is the fact that the entire payout is subject to full, ordinary income tax rates.

After paying Federal income taxes of 27-33% on the proceeds, the net payout in our example shrinks to roughly $800,000.00.

As every advisor knows, it’s not just what one make that counts, it’s what one gets to keep.

Unfortunately, once an advisor has signed on the bottom line, it is generally too late to choose an alternative.

There is an attractive alternative

If you were to leave and join an independent firm, for at least one year, and then sell your practice, you would typically receive between one to three times the full trailing-twelve month production of your book.

If we use a conservative multiplier of 1.5, such a sale would gross $1,500,000.00 to the retiring broker. Because the IRS recognizes such transactions as the sale of an owned business asset, the proceeds are subject only to long-term capital gains tax (currently 15 – 20%).

Depending upon whether you sold for a lump sum or taken over a period of years, after paying capital gains tax, you would get to keep between $1,200,000.00 and $1,275,000.00.

Moreover, if you have a handful of clients you really enjoy working with and wants to remain somewhat active, as an independent you could continue actively working part-time.

There are many variations within the independent universe, but going that route is not for everyone.

If you would like to discuss how one or more such opportunities could potentially benefit you, we are experts at this and are as close as your telephone.

But don’t wait, taking advantage of this opportunity to earn more, and keep more, takes time and planning…things with which you should already be intimately familiar.